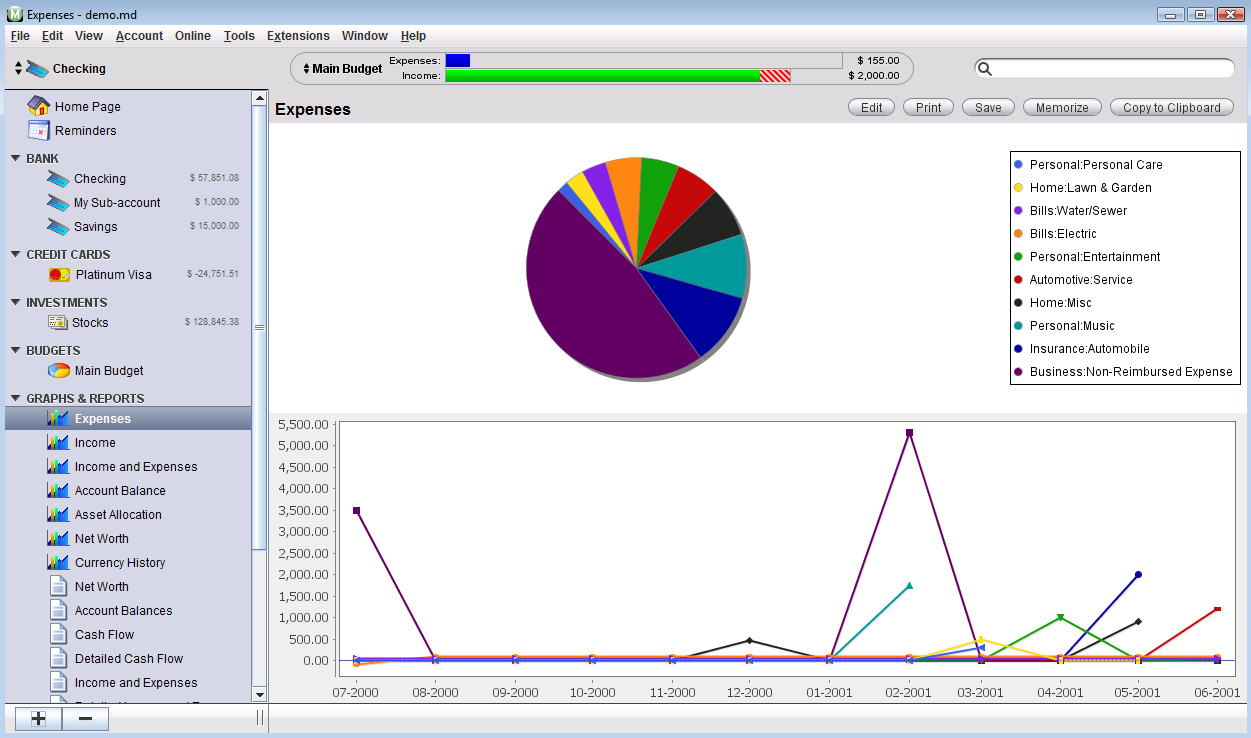

Every month, I draw down money from the laptop account in to an account called "depreciation". When I buy a laptop, I create a new account for the laptop, and transfer the money from my checking account to the virtual account that represents the value of the laptop. It makes recording the value of unconventional assets easier. I can easily see if I'm over or under budget by looking at the value of the virtual account "Holiday Budget" at any point. This keeps my net-worth and budgeting reports very simple - they say I spend the same $x on holidays every month - while accounting for some very lumpy spending. Whenever I spend money on a holiday item from my checking account, the "from" is my checking account, and the "to" is my "Holiday Budget". I have a virtual account called "Holiday Budget", which makes a transaction to another virtual account called "Spent on Holidays" of $x every month. It can also make budgeting and cash-flow visualization easier. In this case, that virtual account would be the same as a "category" in a spreadsheet based model. I might decide to aggregate all such bank charges to a single virtual account for this purpose. The from is my checking account, and then there are two "to" accounts - an account which models the value of the stock, and an account for the vendor's charges for the purchase.

This is a pain to model in a spreadsheet, where I literally create two entries, but very easy to model in an electronic dual-entry system where I create a single transaction with a from and a to end point, and an amount.Ĭonsider if I decide to buy a stock from my checking account. In the simplest example, I move $100 from one checking account to another. When you think about it, all transactions have naturally (at least) a from and a to account.

As your finances become more complicated it kind of goes like this: intellectually interesting -> super cool -> crap, how did I get by without this? -> there is absolutely no other way to do it and not get arrested for tax evasion.ĭouble-entry refers to the number of accounts related to a transaction, rather than the process of entering it twice. Is it necessary for your average person? Obviously not. over or underspend a particular "lot"), the numbers won't balance at the end. Double entry accounting will totally save your butt as you ripple through all your transactions changing the exchange rate for the foreign currency. Fixing that mistake is a nightmare (especially if you have to pay capital gains tax in a LIFO or FIFO manner - you have to record the capital gains or losses for each "lot" of currency that you purchased). Similarly, for me, I have sometimes gone back and discovered that I got an exchange rate wrong.

Especially for complicated areas, like my payroll, where I have up to 5 bank accounts in play (some of them off shore), it's absolutely the only way they can go back and understand what the heck is going on. So, if I document an expense that I want to get a deduction for, they can easily check that there is a corresponding withdrawal from the bank account to pay that expense. This is because it saves them huge amounts of money. In Japan, the government actually gives me concessions for submitting my documents for income tax as double entry accounting. It definitely does help in making sure that you don't make mistakes when you enter the data, but where it really shines is analysis after the fact. You can think of double entry accounting as unit tests for your financial books.

0 kommentar(er)

0 kommentar(er)